House Price Index – November 2023

Posted on Monday, 13 November, 2023

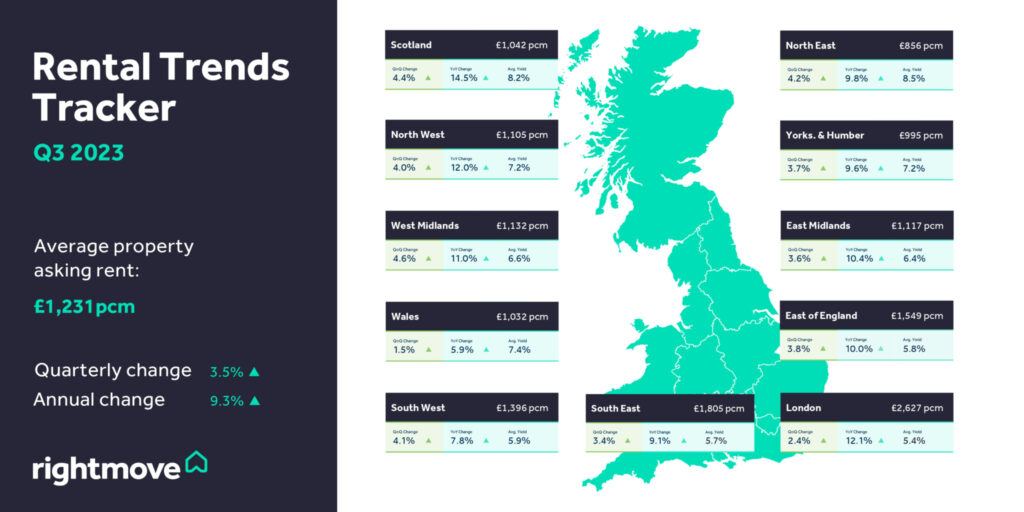

The year has exceeded expectations, with sellers adopting more competitive pricing strategies. The average property asking price is now £362,143 and the average rent £1,231 PCM

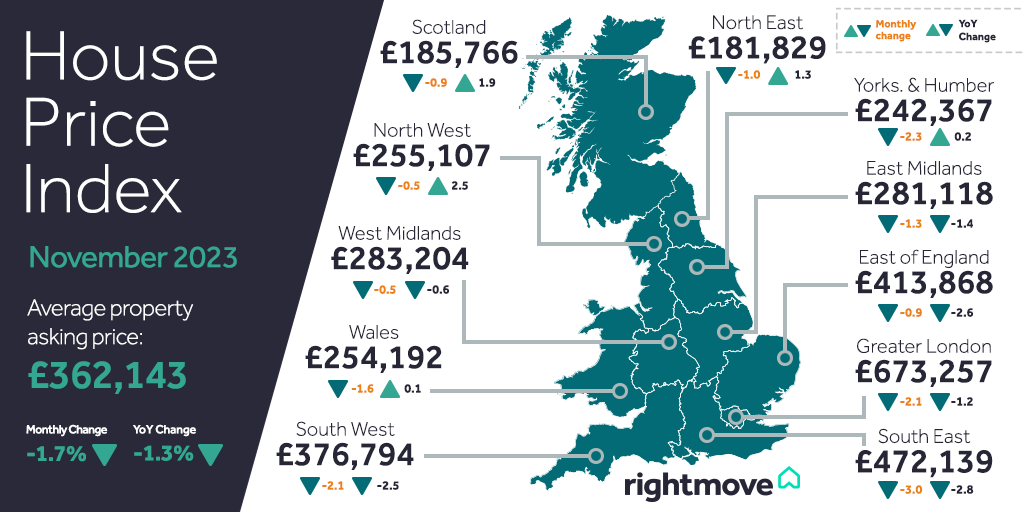

The current year is surpassing expectations, with sellers adopting more competitive pricing strategies. This month, average new seller asking prices have decreased by 1.7% (-£6,088) to £362,143 as Christmas approaches, reflecting a trend toward pricing realism to attract buyers.

Despite the gradual shift from the frenzied pandemic market to more normal activity levels, key indicators suggest a more positive year than anticipated after the tumultuous end of 2022. Asking prices are only 3% below May’s peak, emphasizing the importance of correct pricing from the start to secure a buyer. Sales agreed are now 10% below 2019 levels, an improvement from the 15% decrease observed last month. The pandemic-induced stock shortage has ended, with available properties for sale just 1% behind 2019.

However, certain regions and market sectors are adapting to the need for more enticing pricing better than others. Sales for studio, one-, and two-bed properties are only 7% lower than 2019, while four-bed detached houses and larger properties see a 14% decline. Wales, Scotland, and the North of England experience price increases, contrasting with yearly declines in the Midlands and all Southern regions.

The two consecutive Base Rate holds have helped maintain buyer demand at 2019 levels. The upcoming Autumn Statement is anticipated, with hopes for more than just a renewal of the mortgage guarantee scheme.

In November, new seller asking prices dropped by 1.7% (-£6,088) to £362,143. This decline, typical for this time of year, is the largest in five years, indicating sellers are increasingly setting more realistic prices from the start. Despite challenges, the market in 2023 has been more positive than predicted.

Tim Bannister, Rightmove’s Director of Property Science, emphasizes the importance of pricing right initially, citing increased understanding among sellers that the chances of securing a buyer are greater with accurate pricing.

The year, despite its turbulent start in 2022, has been more favourable than expected. Asking prices, now just 3% below May’s peak, indicate stability. Sales agreed are 10% below 2019 levels, an improvement from the previous month’s 15% decline. The stock shortage appears to be over, with available homes just 1% behind 2019.

Regional variations exist, with the smallest homes sector faring better than larger properties. Affordability challenges due to higher mortgage rates persist, with hopes for potential support in the Autumn Statement.

Tim Bannister expresses optimism, stating that the data shows more positive aspects in 2023 than initially thought. The Autumn Statement will likely set the tone for 2024, with expectations for policies supporting the housing market.

Agents highlight the market’s resilience and buyer-favorable conditions. Pricing right is crucial, and sellers who set realistic prices from the start benefit. Challenges include record rents impacting first-time buyers and landlords exiting the market. Incentives are needed to encourage landlords back into the market and improve rental supply.

Agents stress the importance of choosing the right agent and pricing strategy. With increased buyer choice, realistic pricing is crucial. Two consecutive Base Rate holds, stable mortgage deals, and a sense that rates may have peaked provide assurance and confidence to buyers.

Source: Rightmove.co.uk